Future-Proof your nCino

Monthly Release Testing

With pre-built NoCode nCino Test Automation assets

With pre-built NoCode nCino Test Automation assets

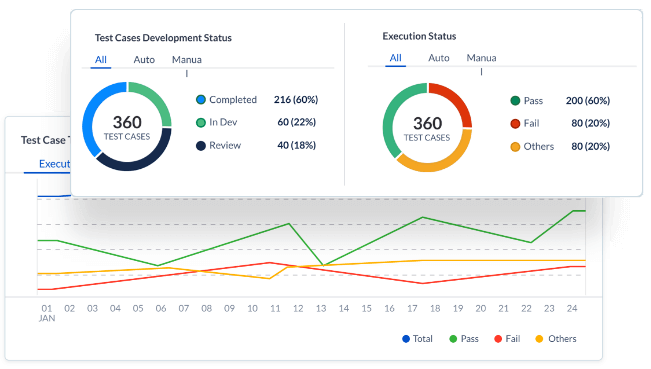

Speed Digital Assurance

Empower Business Users

Achieve Continuous Delivery

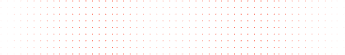

Deep vendor alignment with live cloud link that auto-updates automation assets

Business process modeled no-code automation assets with real time vendor release alignment

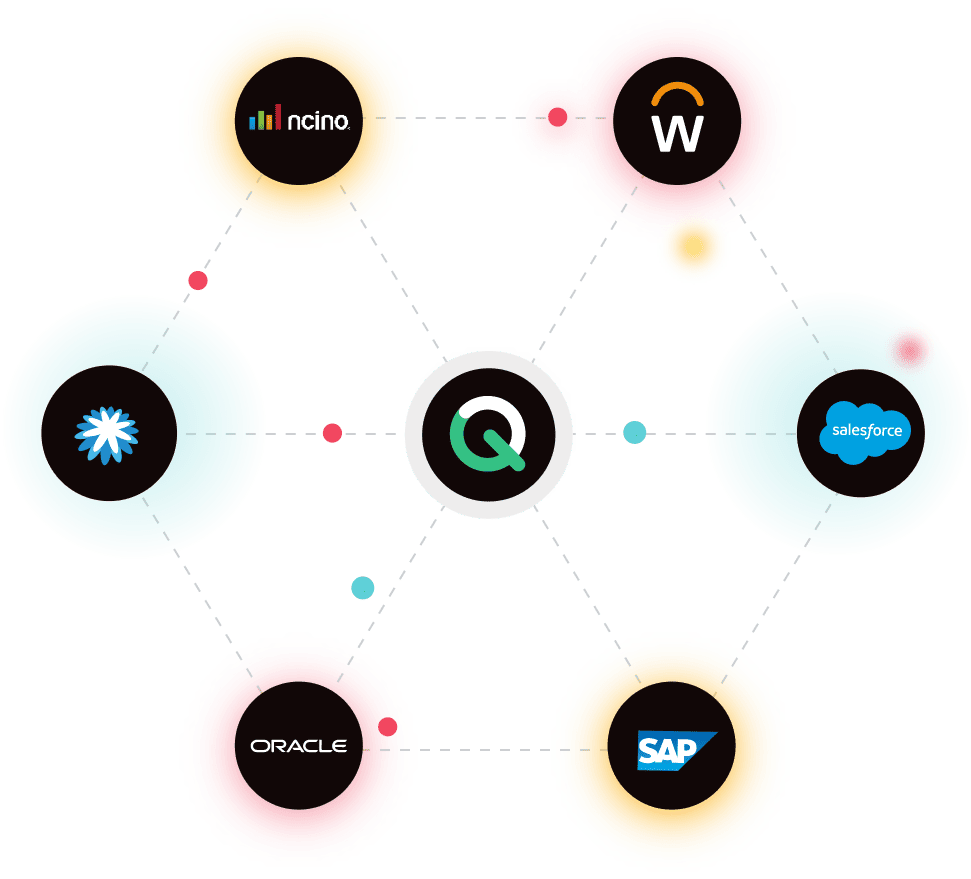

One-stop approach to Test Automation across all Enterprise Apps and technology stacks

Codeless approach to automation of all nCino prodcuts spanning across various businesses and industries.

Commercial Banking

Consumer Banking

Corporate Banking

Mortage Suite

Small Business Banking

Treasury Management

It has been amazing to see our transition to true Continuous Test Automation. ACCELQ has driven this transformation for us by shifting left and enabling in-sprint automation for our Salesforce Implementation.